A Guide To Navigating Cost of Goods Sold at Your Restaurant

If you own a restaurant, you know that numbers are crucial to your success.

That is why it's so important to understand what the cost of goods sold at your restaurant are, and how to calculate them properly!

What does the cost of goods sold mean in restaurants?

In the restaurant, the cost of goods sold (COGS) refers to the entire price of the products, garnishes, and condiments used in restaurant preparations for the meals on the menu. Indirect charges like distribution costs and sales force costs are excluded.

To put it another way, because the cost of goods sold is the cost of purchasing or manufacturing things sold by a business over time, only costs directly linked to the manufacture of the products, such as labor, material, and material and manufacturing overheads, are included in the measure.

For a particular meal to be available on a menu, you will need to purchase some food ingredients first. Then, it goes through the preparation process before appearing on the menu.

The identical process repeats itself over time, except for one variable: the price of the produce. Because of its shifting nature, the price of the ingredients has a significant impact on your COGS.

To stay in profit, you must always determine your COGS. If you don't keep track of these, you will not notice when you need to make adjustments and, before you know it, you've already lost money.

As a result, it's critical to track your COGS regularly to verify that each menu item's price leaves you with enough profit. By doing this, you can know when to increase the price of a menu item to make up for the fluctuations in COGS or decrease the number of meals you serve to customers.

What is the formula for calculating the cost of goods sold?

The formula for calculating the cost of goods sold is: Beginning Inventory + Purchased Inventory - Ending Inventory = Cost of Goods Sold.

You can summarize this in a more precise way:

let’s say; COGS = BI + PI - EI.

Now, from the above formula, the beginning inventory is what you have as leftover. It can be from last week, last month, or even last year, depending on when you choose to calculate your COGS.

Let's say the ingredients you purchased throughout the previous month summed up to $6000. After checking what you already have, you'll need to add $9000 worth of ingredients—possibly because you don't want to run out of condiments before the month runs out.

Finally, now that we've reached the end of the month, you'll go back and double-check the value of the components you still have left. Let's say you have $1500 worth of ingredients as the balance. You can do your calculations now as follows:

Using COGS = BI + PI - EI

BI = $6000

PI = $9000

EI = $1500

COGS = $6000 + $9000 - $1500

COGS = $13500

If you are starting a new restaurant, there won’t be any previous ingredients. So you will not be using the formula above for your calculation. You will have to make your computation using the formula below for your first COGS for the first week, month or year.

COGS = PI -EI

PI is the cost of the product purchase you made for the month you started your restaurant business. And EI is the value of the ingredients you have left over at the end of the month.

What is included in the cost of goods sold?

The following are included when calculating the cost of goods sold:

- The cost of commodities, cargo, or shipping costs: Ingredients you purchased at a market or straight from a manufacturer are referred to as commodity costs. After you've paid for the products, you'll need to figure out how you'll get them to the storage area at your restaurant. Transporting your materials will cost you money, and this cost can be accounted for in your inventory and COGS calculations.

- The cost of the product storage that the restaurant sells: This is the expense of the gadgets or other instruments you'll need to keep these things fresh and usable for as long as they serve their intended objectives.

- Direct labor costs for manufacturing workers: You can connect this to the component of payroll of the production, a specific work order, or service provided by direct labor expenditure. It is the total of all labor expenditures of employees who work directly with materials to create ready-made products. Work costs per unit are computed by multiplying the direct work rate by the amount of time it takes to complete merchandise.

- Overhead factory expenditure: The additional costs during the manufacturing process, excluding direct labor and direct supplies, are referred to as factory overhead.

Is labor cost included in COGS?

Yes, labor is included in the COGS, but only labor that is involved in production. Direct labor, indirect labor, and any direct costs of materials used in creating or manufacturing a company's products are all included in COGS. It does not include secondary charges like distribution and sales force costs.

Because labor is a part of your cost of goods sold, you need to know what it entails. You can save your business thousands by managing labor costs. The cost of labor is divided into two categories: direct and indirect overhead.

Direct labor is the cost of employees who work directly on meal preparation. Indirect labor is non-preparatory work that is an integral part of the production process. The direct cost of labor for the things sold or the services is part of the cost provided the work is directly linked with the production. Consequently, COGS or gross profit affect direct costs.

What is the difference between COGS and food cost?

The cost of goods sold (COGS) differs from the cost of food because COGS is the cost of making a product out of components or raw materials, while food cost is the difference between a restaurant's cost of ingredients and the income earned when you make food sales.

You can see this more clearly by comparing the formula for COGS and food cost.

Food cost = Beginning Inventory + Purchases - Ending Inventory / Food Sales

COGS = Beginning Inventory + Purchases - Ending Inventory

From the above formula, you notice that the calculation for food cost takes account of the total food sale, unlike the COGS.

To calculate your food cost percentage, divide your actual food expenditures or usage by your total food sales.

Food prices are significant since they directly influence a restaurant's profitability. Because of the influence food costs have on a restaurant system, it's one of the first things you should look into if your platform is losing money.

When you cease keeping track of your inventory, your food costs will start to grow. You should calculate your weekly food inventory on the same day each week so that you can address any issues immediately.

The calculation of the material or labor utilized for food preparation, on the other hand, is more consistent in terms of COGS.

What is a good percentage for the cost of goods sold?

A decent percentage for the cost of goods sold should be between 30% and 39%. For example, in one business and for one restaurant, 30% may be a decent margin, but not in another. The size and sales a restaurant makes can influence the percentage cost of goods sold.

Again, 65% of your overall cost of goods sold and labor expenses is decent. If your company runs in a costly market, expect a lower percentage.

A restaurant with a 40% food cost can be profitable, whereas a restaurant with a 20% food cost can be losing money. Gross profit for financially sustainable restaurants is roughly 70%, which means that for every $100 a guest spends at your facility, you make $70 in profit.

As a restaurant owner, you must understand what each percentage represents and how it relates to the overall health of your business. Your Cost of Goods Sold metric indicates how well you're managing your inventory.

COGS is a crucial indicator for restaurants that want to increase sales and maintain their business profitability. To run a profitable restaurant or bar, you'll need a solid understanding of accounting principles. Again, you can calculate COGS for each meal or drink sold. You should be calculating your COGS using the overall inventory count.

How technology can help.

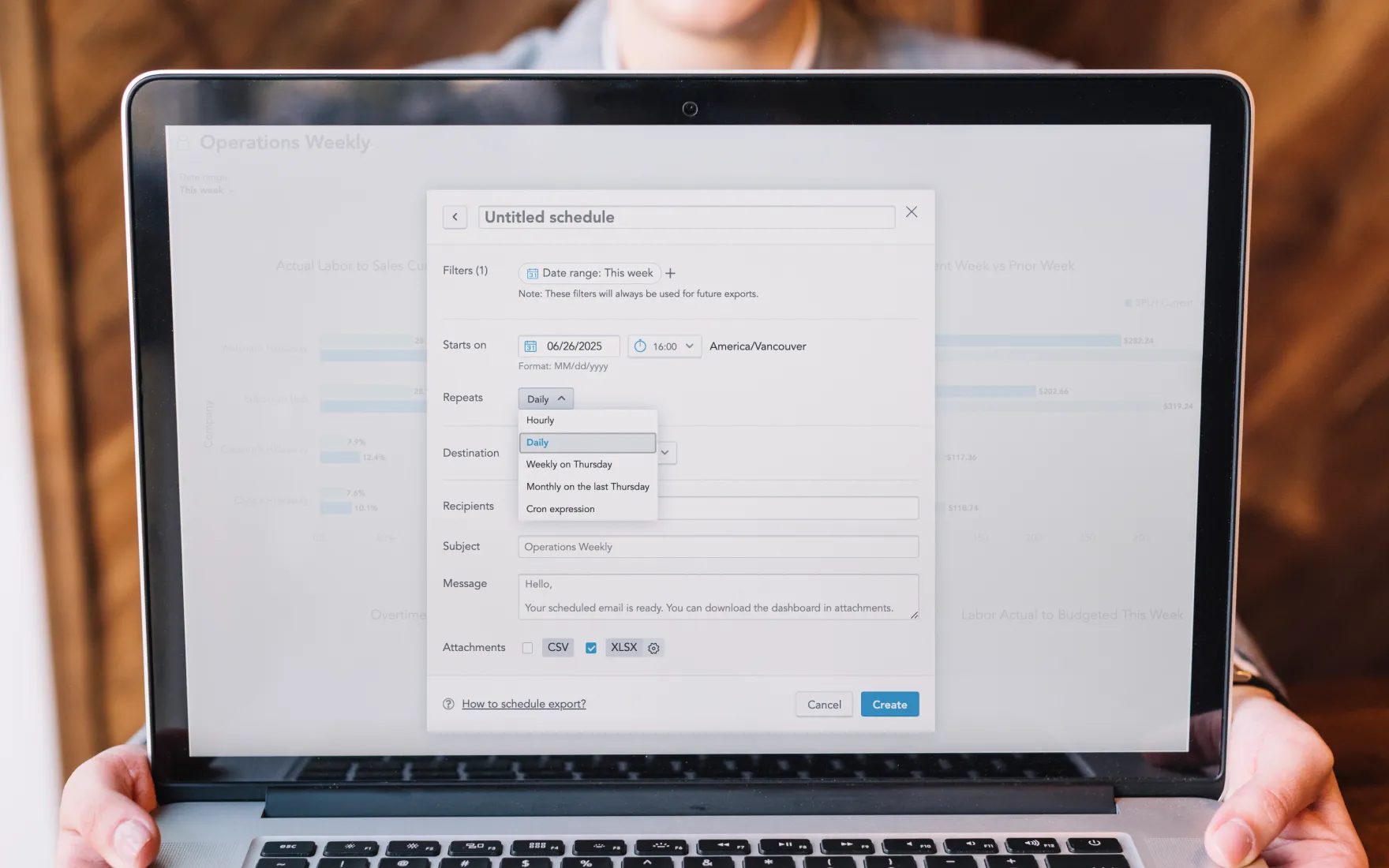

Technology that increases ability to track, measure, and predict inventory is helpful to increase probability. Additionally, technology that assists with marketing, people management and overall restaurant operations will help you succeed and lower costs.

Want to learn more about how to lower your restaurant costs?

Check our free webinar replay below with the experts from Touchbistro!