A Comprehensive Guide to Retroactive Pay

Retroactive pay, also known as retro pay, addresses discrepancies between actual work performed and the compensation received. Payroll mistakes happen for various reasons. These errors can lead to delayed wage payments, requiring employers to provide compensation. This adjustment ensures fair and equitable remuneration, mainly when wage increases or adjustments are implemented late. Paying retroactively in the restaurant industry aligns pay with legal requirements, supporting workers who depend on consistent income.

What Is Retroactive Pay?

Retroactive pay is compensation added to an employee's paycheck to make up for shortfalls in the previous pay period.

When Is Retroactive Pay Required?

As an employer, you're obligated to pay your employees retro pay when any of the following happens:

Salary Adjustments

Employees are entitled to retroactive pay if the payroll department fails to update their records after promising a salary increase starting on a specific date. Employees are rewarded for the difference in their old and new salaries for the period in question, reflecting the true value of their work.

An employee's retro pay can also include commissions and bonuses earned through the company's incentive programs and other compensation that were missed in previous payrolls.

Payroll Errors

Payroll errors happen, especially if the department still does it manually or their software falls short. If the pay rate or hours worked are wrong, it can lead to incorrect wages. Missed payments, usually a payroll error, can happen if an employee's paycheck is delayed or a payment period is missed due to administrative mistakes or technical issues.

When these errors occur, retroactive pay is needed to fix the discrepancies. Promptly correcting payroll errors ensures your business is compliant with wage laws. It also shows your business takes accountability seriously.

Compliance With Labor Laws

Several key laws govern retroactive pay in the US, like the Fair Labor Standards Act (FLSA) and state and local wage laws. The FLSA regulates minimum wage, overtime pay, and wage timing, ensuring employees receive correct overtime pay and retroactive adjustments if needed. Beyond federal rules, states and local areas may have their own laws on retroactive pay violations.

For instance, according to U.S. labor law, employees have a higher pay rate when they work in excess of 40 hours per week. In this case, the employer must pay the employee according to the difference between regular and shift differentials. At times, shift differentials aren't instantly reflected in the payroll, so retro pay is implemented in the next payment cycle.

When retro pay isn’t paid when necessary, an employee can take their employer to court for not only the amount owed but also discrimination, retaliation, or breach of contract.

How to Calculate Retro Pay?

The formula for calculating retro pay is straightforward:

Retro Pay = Amount Owed – Amount Paid

Determine the Correct Pay Rate

Check the employee's pay history and the reason for the adjustment. Make sure you have the correct pay rate for each affected period. Look into these details:

- Is the employee salaried or paid hourly?

- Is the employee exempt from receiving overtime pay?

- How many pay periods need to be reviewed?

Consult company records, contracts, and legal requirements to find the correct rate for each period.

Calculate the Difference

- Hourly Employees: Find the error and the correct rate for the hours worked. Multiply the difference by the hours to get the retro pay. Add this amount to the current paycheck. If the hours exceed 40, overtime pay should be added.

- Salaried Employees: This is trickier to calculate. Compute the difference between their salary and what they should have been paid. Calculate their daily rate using the number of working days in the year. For accurate results, it's easier to use payroll software to simplify.

Include Overtime and Benefits

When calculating retro pay, include any overtime and benefits. For overtime, use the correct rate (usually 1.5 times the regular pay) for all hours worked. Also, benefits like health insurance or retirement contributions can be adjusted based on the new pay rates. Ensure any percentage-based benefits match the retroactive pay changes.

Retro Pay and Taxes

Even though retro pay corrects a past paycheck, it must still be taxed. Retro pay is taxed just like regular wages. Use the percentage or aggregate method to withhold federal income tax from this extra pay. Also, FICA taxes and any state or local taxes should be withheld. Check with your state government for specific state and local tax rules. If you issue a separate check for retro pay, it is still taxed the same way as regular pay.

Best Practices for Implementing Retroactive Pay

To avoid or reduce retroactive pay, you need proactive and strategic planning in HR management. Here are some best practices:

Transparent Communication

Explain the retroactive pay process, timelines, and compensation policies to employees. Pay transparency helps manage their expectations and reduces surprises that could lead to retroactive pay issues. Give detailed paystubs so employees can spot any errors.

Accurate Record-Keeping

Keep correct and updated payroll records to avoid mistakes. Set up regular performance reviews to evaluate employee work and link salary increases to performance merits and market changes.

Use Payroll Software

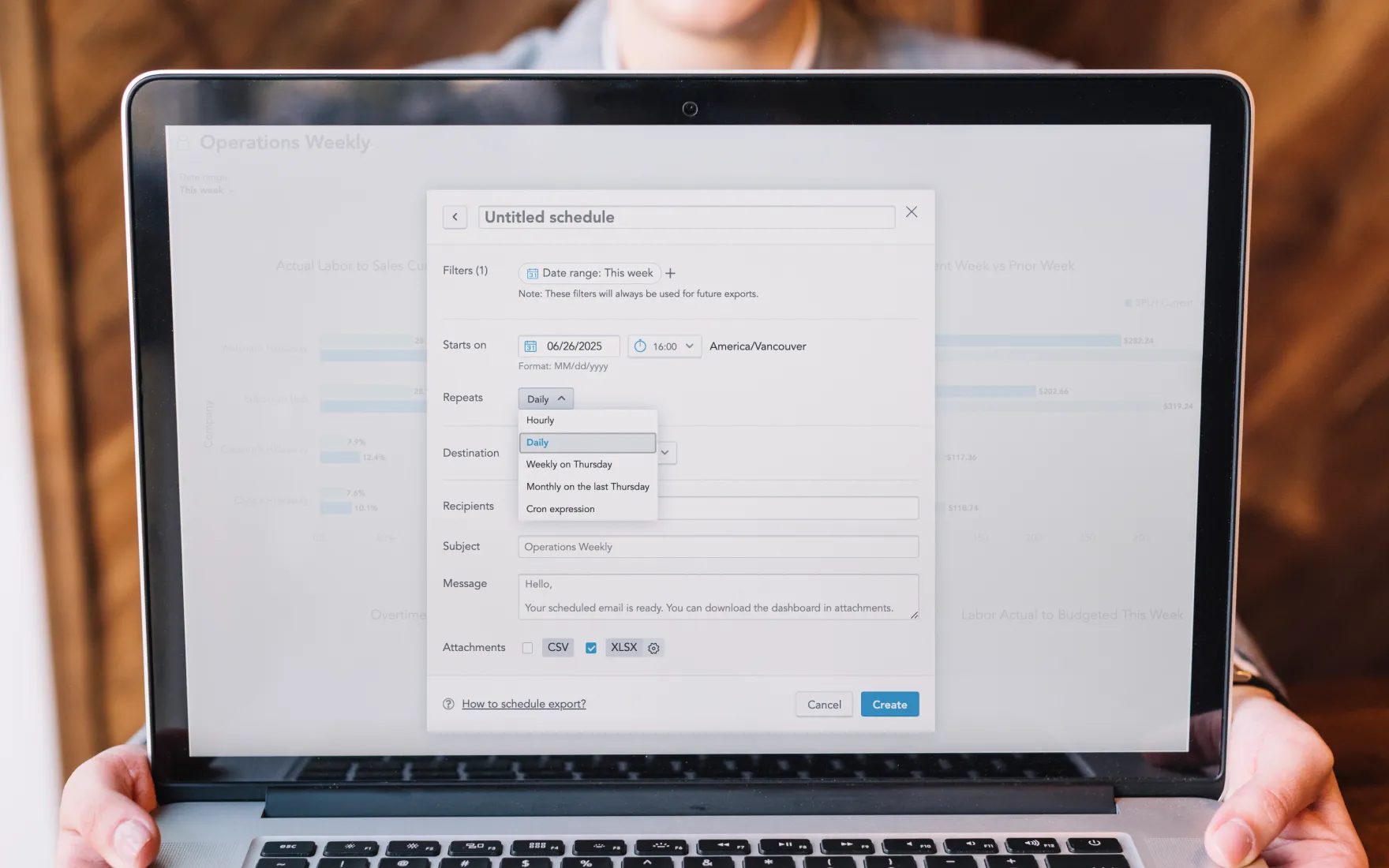

Tools like Push's payroll solutions help ensure accuracy and streamline the payroll process. Push's cloud-based software automates calculations for pay rates, overtime, bonuses, and taxes, providing quick and accurate retro pay figures. It reduces payment mistakes, leading to smooth operations and working relationships between employers and employees. Push’s comprehensive payroll software for restaurants:

- Allows you to run payroll in 10 minutes

- Saves an average of 6 hours a week

- Automates payroll calculations

- Provides real-time payroll reporting

- Offers flexible wage tracking

- Gives employees quick online access

- Helps you stay up-to-date on laws and compliance

- Manages multiple locations

Legal Compliance

Regularly review labor laws and regulations to stay compliant. Keep up with changes in minimum wage, overtime, and other pay laws. Push's HR+ helps you:

- Connect with HR experts and access resources

- Get alerts and updates on changing employment laws

- Hire better with innovative tools like the Job Description Builder and Salary Compare

- Create a state-compliant employee handbook with updates and alerts

- Simplify compliance and safety training in one place

Avoiding Future Retro Pay Errors

Working in a restaurant builds camaraderie. One way to break this bond is to disregard pay issues. Giving employees the retroactive pay they've worked for shows how you value their contribution to the company. It also underscores how your restaurant follows wage laws. To avoid future pay errors, use Push to spot mistakes, notify the payroll team, and make accurate adjustments. Book a demo to experience how an all-in-one people management software can elevate your restaurant operations.